|

HOME PHILOSOPHY PRINCIPAL SERVICES RESEARCH PROPRIETARY TECHNOLOGIES FORTHCOMING BOOK SITE MAP CONTACT US |

|

||

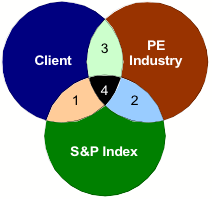

Customized BenchmarkingThere are four possible benchmarks for private equity:

Benchmarks 1 and 2 are calculated as shown in Long and Nickels 1996. Benchmark 4 is simply the difference between benchmark 1 and benchmark 2. Benchmarks 1, 2 and 4 require only client cash flow and valuation data, combined with readily available public market index performance data. Benchmark 3, on the other hand, requires accurate, readily available return data for the private equity industry as a whole. In addition, benchmark 3 should be customized to reflect each investor’s risk/return/correlation profile (otherwise, the investor’s returns might be compared to the returns of investors who have taken much more risk to achieve them). |

home | philosophy | principal | services | research | proprietary technologies | forthcoming book | site map | contact us

© 2008 Alignment Capital Group, LLC.