|

HOME PHILOSOPHY PRINCIPAL SERVICES RESEARCH PROPRIETARY TECHNOLOGIES FORTHCOMING BOOK SITE MAP CONTACT US |

|

||

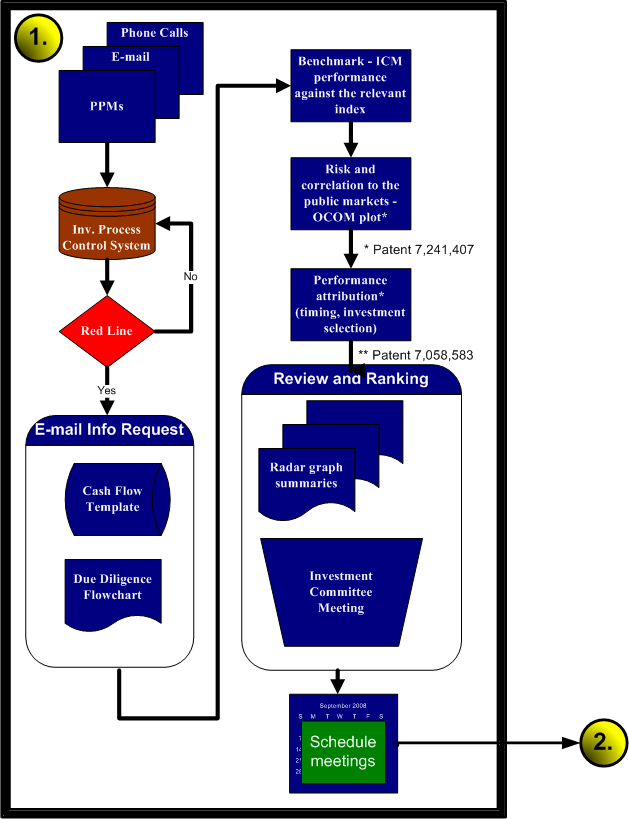

Investment Process Review and RationalizationPublic policy requires that fiduciaries follow a structured investment process. Historically, the lack of available data and the necessity of highly detailed due diligence in private equity has made it difficult to create a uniform investment process. ACG believes that designing and implementing a disciplined investment process is required in order to produce replicable returns and to build an institutional-quality private equity program. ACG has developed an investment process based, in part, upon its proprietary analytical tools and techniques and, in part, on 21 years of experience in investing in the private equity market. Chart of the investment process Due DiligenceAlignment Capital Group has refined its due diligence process over many years of investing in the private markets. The process consists of four principal steps: INITIAL SCREENING

The first step, quantitative screening, involves processing each investment manager’s track record of cash-flow data through a battery of quantitative filters designed to test its performance against both the private equity universe and a set of opportunity-cost benchmarks. These tests also separate the replicable returns in a particular strategy from returns that result from a prolonged trend in the public markets. Quantitative filters include:

Quantitative track-record screening is ACG’s standardized process for assessing investment opportunities and for measuring the potential for future success. Going far beyond a simple recalculation of IRR, ACG can analyze the strengths and weaknesses of a track record in order to determine whether an opportunity is appropriate for the investment strategy of a client. For example, a potential investment opportunity may have produced outstanding returns in terms of IRR in a prior fund. ACG can determine how correlated those returns were with any public-market index and what proportion of those returns is “alpha” versus the return associated with the public market. The firm can also determine the likelihood that a particular manager’s style will add to or detract from the diversification of a client’s portfolio. Example: Initial screening Once the quantitative screens have been completed, the investment committee should meet to review the results and to decide which investment opportunities warrant further investigation. This process allows the investment committee to filter an annual flow of 400 deals down to the 30 or so that are eligible to advance to the next stage.

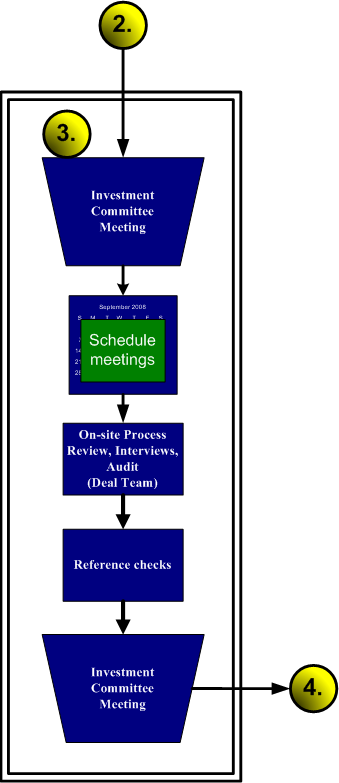

MANAGEMENT PRESENTATIONIf a potential investment passes quantitative screening, the staff should invite the investment managers to give an initial management presentation in the institutional investor’s offices. The candidate managers deliver their typical management presentation to the staff, who should discuss with the candidate managers any differences between the track record presented and the cash-flow data analyzed during the quantitative screening. In this interview, the institutional investor’s staff can inquire about the anticipated investment strategy, including any changes (such as in personnel) that might affect the fund’s ability to replicate the past track record.

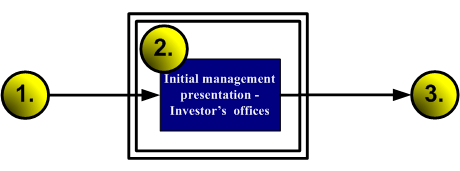

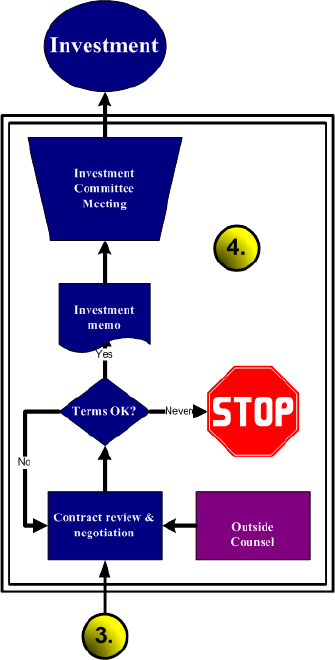

DETAILED QUALITATIVE DUE DILIGENCEThe next step is a rigorous qualitative review of each investment opportunity in a two-day on-site meeting with the candidate manager’s entire investment team. This carefully documented process allows the institutional investor’s staff to assess potential risks, to evaluate a fund’s ability to achieve success, and to ensure there is an alignment of interests between the manager and the institutional investor. On-Site Structured InterviewThe investor’s staff schedules a two-day on-site interview with the investment management team to inquire about every aspect of the team’s operations. The investor’s staff takes note of the team members’ integrity, acumen and reputation, as well as such psychological factors as the team’s motivation, decision-making profile, interpersonal dynamics and reaction to pressure. The staff looks for potential changes in group dynamics that might alter the group’s ability to achieve in the future the returns realized in the past. File AuditThe investor’s staff should verify the financial data submitted for the quantitative screening by examining files at the on-site meeting. This exercise is an effort to uncover any patterns of excessive optimism or routine exaggeration or any evidence of misrepresentation. During this process, the staff should also examine the candidate’s deal flow to assess its quantity and quality and its investment management systems to ensure that they are capable of controlling the amount of capital to be committed and the number of investments to be made by the fund being raised. Structured Reference CallsAdditionally, the staff should check references within a wide network of limited partners, general partners and industry contacts to determine the business and investment reputations of the investment. The ACG approach to the due diligence process, in contrast to the usual institutional investor’s due diligence process, uses the quantitative screening step to remove a large number of in-person meetings from the calendar. The institutional investor’s staff can then spend more time on fewer potential managers—or, put another way, the staff can avoid wasting time on managers with no hope of a commitment. All of the due diligence above, from the results of the initial quantitative screen to the outcome of the on-site interviews and audit, should be incorporated into an investment recommendation for review prior to a formal vote of the investment committee. Example: Detailed quantitative due diligence CONTRACT REVIEW AND NEGOTIATIONAfter the potential investment has been approved by a formal vote of the investment committee, the investor’s counsel, in close coordination with the investor’s staff, should review the partnership agreement and begin preliminary negotiations for changes relating to the needs of the client. Typical concerns include:

ACG has the experience resulting from reviewing, negotiating and closing more than 150 partnership agreements over nearly two decades to help align the interests of the client and the investment manager as closely as possible.

MONITORINGMonitoring of the portfolio isn’t usually conceived of as a due diligence measure. However, the monitoring process results in actual experience with a manager, a far superior source of information over the experience of others. Monitoring is therefore the very best due diligence available and the knowledge and experience derived from monitoring should therefore be thought of as an integral part of the overall investment process. |

home | philosophy | principal | services | research | proprietary technologies | forthcoming book | site map | contact us

© 2008 Alignment Capital Group, LLC.