|

HOME PHILOSOPHY PRINCIPAL SERVICES RESEARCH PROPRIETARY TECHNOLOGIES FORTHCOMING BOOK SITE MAP CONTACT US |

|

||

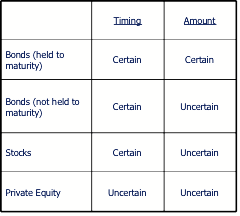

Cash Flow ProjectionPrivate equity is the most uncertain of all the asset classes.

This table shows the timing of investments in publicly traded securities as certain because it is at the option of the investor. Note that, in these terms, private equity is the only principal asset class in which the investor’s uncertainty extends to both the timing and the amount of the cash flows of an investment. The irregular and unpredictable nature of cash flows into and out of private equity investments and portfolios of private equity investments can make reaching and maintaining a targeted level of private equity exposure a difficult proposition. Unlike traditional investments, dollars allocated to private equity are not fully invested immediately and private equity funds, by their nature, eventually mature and liquidate entirely. These characteristics expose the private equity investor to pre-investment risk and re-investment risk, in addition to the investment risk taken by the fund manager. Alignment Capital Group believes that portfolio cash flow projection provides valuable information that can be used to set return expectations and to design and monitor investment policy. ACG has developed proprietary tools that probabilistically project into the future the expected cash flows and valuations of the funds in a private equity portfolio. These models are customized to forecast the risk/return/correlation characteristics of an individual client portfolio. The ACG portfolio projection model is customized to each client’s particular portfolio in order to ensure that the client makes the optimal investment decision. Specifically, the model considers such factors as: the investment strategies of partnerships in the portfolio, the seasoning of the funds in the portfolio and the rate and sub-asset allocation of expected future commitments to private equity funds. The model uses Monte Carlo simulation to quantify the statistical distribution of possible outcomes under expected, optimistic, and pessimistic market scenarios. For the client, the result is a view of the most likely path the existing portfolio will take over the next several years and a recommendation of the investment policy most likely to maintain or restore the desired return, risk and correlation characteristics. Example: Cash Flow Projection—PowerPoint • PDF |

home | philosophy | principal | services | research | proprietary technologies | forthcoming book | site map | contact us

© 2008 Alignment Capital Group, LLC.